Internetbankig and mobile app service - myRaiffeisen mobile application - Raiffeisen ENGLISH

Asset Publisher

myRaiffeisen makes banking easier.

Our internet banking and mobile app service - myRaiffeisen makes things simple, transparent and intelligent so that you can make better choices.

Discover it now on iOS and Android.

Understand where your money goes.

myRaiffeisen shows your transactions in a clean, straightforward way.

Lenses and automatic categorization helps you understand what drives your money flows: going out, bills & utilities, or maybe just little things which add-up to something big.

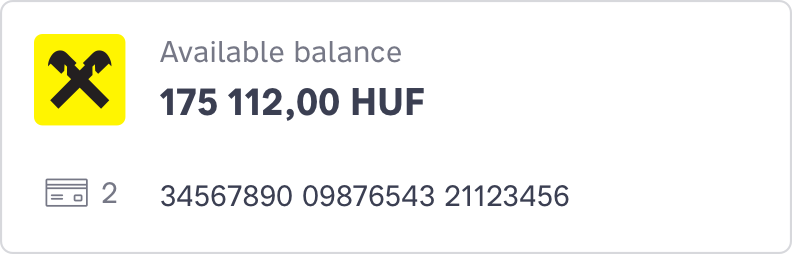

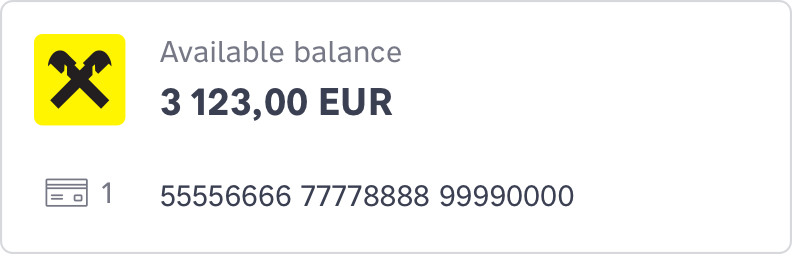

Find everything in one place.

We put all your Raiffeisen bank accounts, debit cards and credit cards in one place so that you can manage them with ease.

Get things done with less effort.

Make payments, manage card limits, share your account details or pay-off your credit card. No more need to visit the branch for small things.

- DOMESTIC PAYMENTS

- SEPA PAYMENTS

- SCHEDULED PAYMENT

- CARD LIMITS

- CARD SUSPENSION

- CARD ACTIVATION

- SET ONLINE PURCHASE ALLOWANCE

- CREDIT CARD PAY-OFF

- CHANGE ACCOUNT NUMBER LINKED TO CARD

- TERM DEPOSIT

- DIRECT DEBIT

- STANDING ORDERS

- SPECIAL FOREIGN CURRENCY EXCHANGE

- QR-CODE TRANSFER (QVIK PAYMENT)

- PAYMENT REQUEST

- RAICONNECT FOR OUR CONTRACTED PREMIUM CUSTOMERS

- ATM & BRANCH LOCATOR

- INVESTMENTS

- OPEN ACCOUNT WITH NFC AND SELFIE IDENTIFICATION

- OFFERS AND PRODUCTS

- REFLEX SAVINGS ACCOUNT

- DISPLAYING INSURANCE

myRaiffeisen is evolving

We, at Raiffeisen, work constantly to bring new things to life and make your daily banking experience even better.

Everyday banking

- View transaction history for all accounts as account owner or trustee

- The transactions are grouped by category, time, amount in Lenses

- Send money quickly, easily and safely with Payments in HUF and EUR from private or business accounts

- View your credit cards and overdraft

- You can create and delete Standing orders (only with single sign)

- You can see, create and withdrawal (except of Private Banking customers) Term Deposits.

- You can see, create and delete Direct debits. The items waiting for collection can be rejected or one above the limit you set can be approved.

- Get a special offer for exchange rates

- QR code transfer (QVIK payment): immediate transfer to a Merchant that allows QR code based payment

Ease of use

- View all your cards and accounts in one place

- Share your bank account details with a few taps

- View all your personal information in one place

- Edit beneficiaries and those will be the same in the internetbank

- myRaiffeisen displays the beneficiaries in favour of whom you can start a HUF transaction or SEPA credit transfer from the application. For more information please click here.

- Bank in Hungarian or English with our bilingual app

- Authorize your DirektNet internet banking login and transactions

Safety & security

- Sign-in securely with TouchID, Fingerprint Authentication or FaceID

- Protect yourself by using Block card feature

- Easily change your card limits whenever you want

Following app functions are not available with joint signature (can be used in DirektNet internetbank):

- Create, delete, withdrawal Term Deposit

- Create and delete Standing Order

- Create and delete Direct Debit

- Delete or accept items waiting for collection over the limit you set

myRaiffeisen is evolving, we work constantly to bring new functions.

How do you get myRaiffeisen?

myRaiffeisen is for existing private individual and business customers of Raiffeisen Bank

To register for myRaiffeisen, you will need:

- an active current account or debit card in Raiffeisen Bank Hungary

- valid credentials for DirektNet internet banking and mobile app service

- a smartphone operating on Android 7.0 or iOS 15.0 or later

Registration is quick and easy! Download the app, log in with your internet banking credentials, activate the Mobile token (with PIN) and you are good to go!

Download myRaiffeisen now on iOS and Android.

For more details, take a look at our Business Conditions, The risk of granting access to the authorised representative, Legal Terms, Terms and Conditions for Private Individuals, Premium Banking, Private Banking, Corporates, User Manual